Giving you more, all in the palm of your hands.

Bank with us anytime, anywhere, on any device.

Benefits You'll Love

- View account balances and history

- Enjoy account access 24/7

- Deposit checks anytime, anywhere

- Pay bills online or from your phone

Online Banking

- Free, secure, and easy-to-use service for Washington Savings Bank customers

- Manage your finances easily, on your own time:

- View account balances and history

- Transfer funds between WSB accounts

- Make transfers between external bank accounts

- Send money to friends and family with Zelle®

- Access eStatements

- Secure forms for routine services:

- Address changes

- Opening new accounts

- Debit card disputes

- Make more time for yourself; fewer bank trips necessary

- See our Digital Banking FAQs

Before you start please make sure your browser supports 256-bit SSL — the strongest encryption available.

Bill Pay

- Pay one-time or recurring bills with ease

- Free with a WSB checking account

- Access all billing information from one convenient screen

- Reduce postage stamps and paper waste

- Set up one-time or recurring payments

- Ensure your payments are received on time

Mobile Banking

- Fast, free, and secure service for customers enrolled in online banking*

- Manage a number of banking functions anytime, anywhere via mobile device:

- Check account balances

- View transaction history

- Transfer funds

- Deposit checks

- And more

- Log in using your finger print (Touch ID)

- Card controls to turn your debit card on/ off and set card limits

- Three convenient forms of mobile banking available:

- TXT Text Message (SMS)

- APP Downloadable Application – Certified Device List

- WAP Thin Client (Web Based Application)

- Highly secure service; world-class 256-bit data encryption

- See our Digital Banking FAQs

LEARN MORE

View our Mobile Banking Demo to see mobile banking in action. Visit our FAQ page for answers to common questions.

GET STARTED

Simply enroll in mobile banking through your online banking access. Select "Options" on the top right menu and scroll down to enroll in mobile banking. You will be asked to register your cell phone number first, then you can select the type of mobile banking you wish to use.

Note: Mobile Check Deposit is only available on the download APP.

Same Day Mobile Deposit

- Deposit checks from your mobile phone

- Posted to your account within 20 minutes!

- Free service for customers with a Washington Savings Bank checking account

- Available to iPhone® or Android™ device users – Certified Device List

- Save time, avoid unnecessary trips to a branch

- Deposit your check in just a few simple steps:

- Download the WSB Mobile app for either your iPhone or Android device

- Sign on to your account on your WSB Mobile app using your WSB online user ID and password

- Choose "Make a Deposit" from the Account Summary Screen

- Select the checking account into which you want to deposit the check

- Enter the amount of your check

- Sign the back of your check to endorse it

- Snap pictures of the front and back of your check

- Submit the check for deposit and you'll receive a confirmation on the spot!

- The next business day you'll see the credit in your account and you can shred the paper check; mobile check deposits made after 8pm will be considered made the following business day

When you endorse your check for mobile deposit, please also write "For Mobile Deposit Only at Washington Savings Bank.”

*Wireless carrier data rates may apply.

- Free service, available through online banking or separately through our secure website

- Email notification sent each month when statement is ready to view

- Access 18 months of statements anytime, anywhere with internet access

- Avoid paper storage hassles and time spent searching for past statements

- Decrease identity theft; remove a paper trail of your private information

- More environmentally-friendly than paper statements

- Easily print or download statements securely to your computer or other storage device

Get Started

- Visit the transaction history page on your online banking.

- Click the DOCUMENTS link near the top of the page.

- Click YES to enroll.

- Click AGREE to accept the terms and conditions of eStatements.

Enrollment Bonus

Get an easy $10 bonus when you enroll in eStatements! Please let us know.

Applies per household (not per account) and all accounts must be enrolled in estatements to qualify. $10 bonus will be credited within 3 business days after notifying the bank of enrollment. This offer many be withdrawn at any time and only applies to accounts that don't require estatements for opening.

Use this calculator to determine your projected earnings from our Interest Rewards Checking account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly interest earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total interest earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Business Money Market Account

| Balance | Minimum to Open | Interest Rate | APY |

|---|---|---|---|

| $10 or more | $10 | 3.38% | 3.49% |

Business Rewards Checking

| Balance | Minimum to Open | Interest Rate | APY |

|---|---|---|---|

| $0 - $10,000 | $10 | 0.20% | 0.20% |

| Over $10,000 | $10 | 0.10% | 0.20% - 0.10% |

| All balances if qualifications are not met | $10 | 0.01% | 0.01% |

Per Qualification Cycle for Business Rewards Checking: Have at least 12 debit card purchases post and clear, receive free eStatements, and access online banking

Certificates of Deposit (CDs)

| Term | Minimum to Open | Interest Rate | APY |

|---|---|---|---|

| 91 Day Certificate | $500 | 3.55% | 3.60% |

| 6 Month Certificate | $500 | 3.47% | 3.50% |

| 7 Month Certificate | $500 | 3.34% | 3.44% |

| 10 Month Certificate | $500 | 0.30% | 0.30% |

| 12 Month Certificate | $500 | 2.80% | 2.88% |

| 15 Month Certificate | $500 | 1.95% | 2.00% |

| 18 Month Certificate | $500 | 3.10% | 3.19% |

| 24 Month Certificate | $500 | 0.39% | 0.40% |

| 26 Month BUMP CD Special1 (bump to higher rate once during term) | $500 | 0.49% | 0.50% |

| 30 Month Certificate | $500 | 0.49% | 0.50% |

| 36 Month Certificate | $500 | 0.54% | 0.55% |

| 49 Month Certificate | $500 | 0.64% | 0.65% |

| 60 Month Certificate | $500 | 0.74% | 0.75% |

A penalty may be assessed for funds withdrawn prior to maturity on all certificates of deposits.

Once a certificate of deposit account is opened, it maintains the opening rate for the length of its term.

You must maintain a minimum balance of $10.00 in an account to earn the stated APY.

1 The 26-month Certificate of Deposit is available as of May 1st 2019 and will renew as a 24-month Certificate of Deposit at the current APY. For the 26-month term only, if the bank offers a higher APY for the same term Certificate during the initial term of your CD Bump Rate Special, customer must contact the bank and request to bump (increase) the APY for the certificate through the remainder of the initial term.

Elite Checking

| Balance | Minimum to Open | Interest Rate | APY |

|---|---|---|---|

| $0+ | $10 | 1.96% | 2.00% |

Our best account designed for customers with combined loan and deposit balances of at least $100,000 or a $25 monthly service charge applies

High Yield Online Money Market

| Balance | Minimum to Open | Interest Rate | APY |

| $10 + | $10 | 3.38% | 3.49% |

$10 minimum to open, $500,000 max deposit, no check writing ability

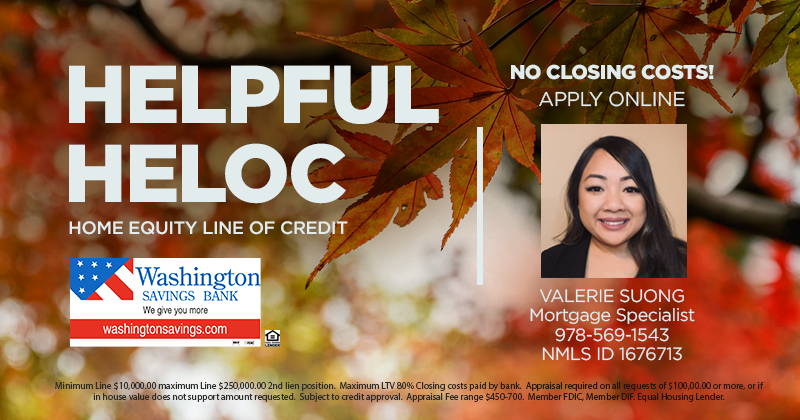

Home Equity Line of Credit (HELOC)

| Type | Maximum LTV | Minimum Line | Interest Rate | Terms |

|---|---|---|---|---|

| Initial rate for the first 12 months 6.74%, Adjustable to prime thereafter maximum adjustment over the life of the loan will be 9.99% with a floor rate of 4.50% | 80% | $10,000 | 6.74% | 10 year draw/10 year repayment |

- Maximum Line: $250,000

- Maximum APR 9.99%

- Floor Rate of 4.50%

- Closing costs paid by Bank

- Rate may change after consummation

- Appraisal required on all requests of $100,000 or more, or if the in-house value does not support the amount requested

- Home owners insurance required

- $40.00 Assess Maintenance Fee

Home Equity Loans

| Term | Interest Rate | APR | Payment per $1,000 |

|---|---|---|---|

| 5 Years | 6.125% | 6.125% | $19.39 |

| 5 Years with Auto Pay | 5.990% | 5.990% | $19.33 |

| 10 Years | 6.500% | 6.500% | $11.35 |

| 10 Years with Auto Pay | 6.375% | 6.375% | $11.29 |

| 15 Years | 7.125% | 7.125% | $9.06 |

| 15 Years with Auto Pay | 6.990% | 6.990% | $8.98 |

| 20 Years | 7.625% | 7.625% | $8.13 |

| 20 Years with Auto Pay | 7.500% | 7.500% | $8.06 |

- Minimum Loan: $10,000

- Maximum Loan: $250,000

- Maximum LTV 80%

- Closing costs paid by Bank

- Appraisal required on all requests of $100,000 or more, or if the in-house value does not support the amount requested

- Interest rate discounted with payments automatically withdrawn from Washington Savings Bank checking or savings account

- Home owners insurance required

- 2nd position liens only

Interest Business Checking

| Balance | Minimum to Open | Interest Rate | APY |

|---|---|---|---|

| $10 - $24,999.99 | $10 | 0.10% | 0.10% |

| $25,000 - $49,999.99 | $10 | 0.10% | 0.10% |

| $50,000 - $99,999.99 | $10 | 0.15% | 0.15% |

| $100,000 or more | $10 | 0.15% | 0.15% |

You must maintain a minimum balance of $10.00 in an account to earn the stated APY.

Interest Rewards Checking

| Balance | Minimum to Open | Interest Rate | APY |

|---|---|---|---|

| $0 - $10,000.00 | $10 | 0.20% | 0.20% |

| $10,000.01 - $20,000.00 | $10 | 0.10% | 0.20% - 0.10% |

| Over $20,000 | $10 | 0.10% | 0.15% - 0.10% |

| All balances if qualifications are not met | $10 | 0.01% | 0.01% |

Per Qualification Cycle For Interest Rewards Checking: Have at least 12 debit card purchases post and clear, receive free eStatements, and make at least one ACH transaction (deposit or withdrawal).

IRA CDs

| Term | Minimum to Open | Interest Rate | APY |

|---|---|---|---|

| 12 Month Certificate IRA | $500 | 2.80% | 2.88% |

| 18 Month Certificate IRA | $500 | 3.10% | 3.19% |

| 24 Month Certificate IRA | $500 | 0.39% | 0.40% |

| 36 Month Certificate IRA | $500 | 0.54% | 0.55% |

| 48 Month Certificate IRA | $500 | 0.64% | 0.65% |

| 60 Month Certificate IRA | $500 | 0.74% | 0.75% |

A penalty may be assessed for funds withdrawn prior to maturity on all certificates of deposits.

Once a certificate of deposit account is opened, it maintains the opening rate for the length of its term.

IRA Money Market

| Balance | Minimum to Open | Interest Rate | APY |

|---|---|---|---|

| $10 - $24,999.99 | $10 | 0.05% | 0.05% |

| $25,000 - $49,999.99 | $10 | 0.10% | 0.10% |

| $50,000 - $99,999.99 | $10 | 0.10% | 0.10% |

| $100,000 or more | $10 | 0.15% | 0.15% |

You must maintain a minimum daily balance of $10.00 to obtain the disclosed annual percentage yield. You must deposit $2500.00 to open this account. Each month you will be assessed a service charge of $10.00. You may avoid this charge if you maintain, each day during the monthly cycle, a daily balance of at least $2500.00.

Money Market

| Balance | Interest Rate | APY |

|---|---|---|

| $10 - $24,999.99 | 0.05% | 0.05% |

| $25,000 - $49,999.99 | 0.10% | 0.10% |

| $50,000 - $99,999.99 | 0.10% | 0.10% |

| $100,000 or more | 0.15% | 0.15% |

You must maintain a minimum daily balance of $10.00 to obtain the disclosed annual percentage yield. You must deposit $2500.00 to open this account. Each month you will be assessed a service charge of $10.00. You may avoid this charge if you maintain, each day during the monthly cycle, a daily balance of at least $2500.00.

Mortgage Loans

New Auto Loans

| Term | APR | Payment per $1,000 |

|---|---|---|

| 5 Years | 7.500% | $20.04 |

| with auto pay | 7.250% | $19.92 |

- Borrowing limits between $1,000 and $50,000

- Borrowing term limits between 1 and 5 years

- Maximum Loan 95% of NADA/Kelly blue book retail value

- A new automobile is defined as a Model Year 2025 or 2026 vehicle with less than 15,000 miles

Non-Profit Money Market

| Balance | Minimum to Open | Interest Rate | APY |

| $10 + | $10 | 3.64% | 3.75% |

$10 minimum deposit to open, $500,000 max balance, no check writing ability

Personal Loans

| Term | Interest Rate | APR | Payment Per $1,000 |

|---|---|---|---|

| 5 Year** | 15.50% | 15.50% | 24.05 |

| 5 Year with Auto Pay** | 15.25% | 15.25% | 23.92 |

| 3 Year*** | 15.50% | 15.50% | 34.91 |

| 3 year with Auto Pay*** | 15.25% | 15.25% | 34.79 |

**5 year term available only to existing customers with an account relationship of one year or more.

***3 year term available to existing customers or new customers.

Minimum Loan: $1,000

Maximum Loan: $5,000 for existing customers. $3,000 for new customers.

New customer is defined as a depositor/borrower with an account relationship of one year or less.

Savings

| Type | Minimum Balance to avoid Service Charge | Minimum to Open | Minimum to Earn Interest | Interest Rate | APY |

|---|---|---|---|---|---|

| Rewards Savings | $0 | $10 | $0 | 0.10% | 0.10% |

| Passbook Savings | $50 | $50 | $10 | 0.05% | 0.05% |

| Statement Savings | $50 | $50 | $10 | 0.05% | 0.05% |

| Vacation Club | $0 | $10 | $10 | 0.05% | 0.05% |

| Christmas Club | $0 | $10 | $10 | 0.10% | 0.10% |

| Prize Savings | $0 | $1 | $0 | 0.05% | 0.05% |

Saver Rewards requires a checking account with eStatements.

Prize Savings is an eStatement account

Passbook Savings and Statement Savings Each month you will be assessed a service charge of $3.00. You may avoid this charge if you maintain, each day during the monthly cycle, a daily balance of at least $50.00:

Special HELOAN with existing WSB 1st Mortage

| Term | Interest Rate | APR | Payment per $1,000 |

|---|---|---|---|

| 5 Year | 6.125% | 6.125% | $19.39 |

| 5 Years with Auto Pay | 5.875% | 5.875% | $19.27 |

| 10 Years | 6.500% | 6.500% | $11.35 |

| 10 Years with Auto Pay | 6.250% | 6.250% | $11.23 |

- For existing Washington Savings Bank Mortgage holders

- Minimum Loan: $10,000

- Maximum Loan: $250,000

- Maximum LTV 80%

- Closing costs paid by Bank.

- Appraisal required on all requests of $100,000 or more, or if the in-house value does not support the amount requested.

- Interest rate discounted with payments automatically withdrawn from Washington Savings Bank checking or savings account.

- Home owners insurance required

- 2nd position liens only

Special HELOC with existing WSB 1st Mortgage

| Type | Maximum LTV | Minimum Line | Interest Rate | Terms |

|---|---|---|---|---|

| Initial rate for the first 6 months 6.49%, Adjustable to prime thereafter maximum adjustment over the life of the loan will be 9.99% with a floor rate of 4.50% | 80% | $10,000 | 6.49% | 10 year draw/ 10 year repayment |

- For existing Washington Savings Bank mortgage holders

- Maximum Line: $250,000

- Maximum APR 9.99%

- Floor Rate of 4.50%

- Closing costs paid by Bank

- Rate may change after consummation

- Appraisal required on all requests of $100,000 or more, or if the in-house value does not support the amount requested

- Home owners insurance required

- $40.00 Assess Maintenance Fee

Used Auto Loans

| Term | APR | Payment per $1,000 |

|---|---|---|

| 4 Years | 8.500% | $24.65 |

| with auto pay | 8.250% | $24.53 |

- Borrowing limits between $1,000 and $30,000

- Borrowing term limits between 1 and 4 years

- Maximum Loan 90% of NADA/Kelly blue book retail value

- A used automobile is defined as a Model Year 2021 or newer vehicle with less than 100,000 miles